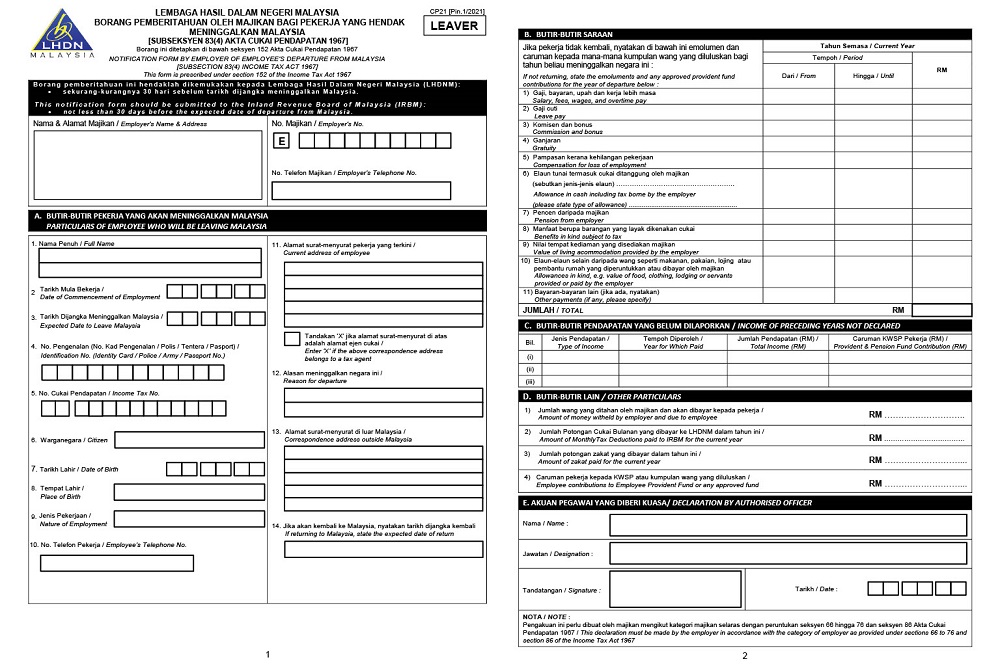

Basis Period for Company. The CP38 notification is issued to the employer as supplementary instructions to clear the balance of tax liability of employees over and above the Monthly Tax Deductions MTD 30th.

Hr Guide Tax Clearance Letter Form Cp22 And Form Cp22a

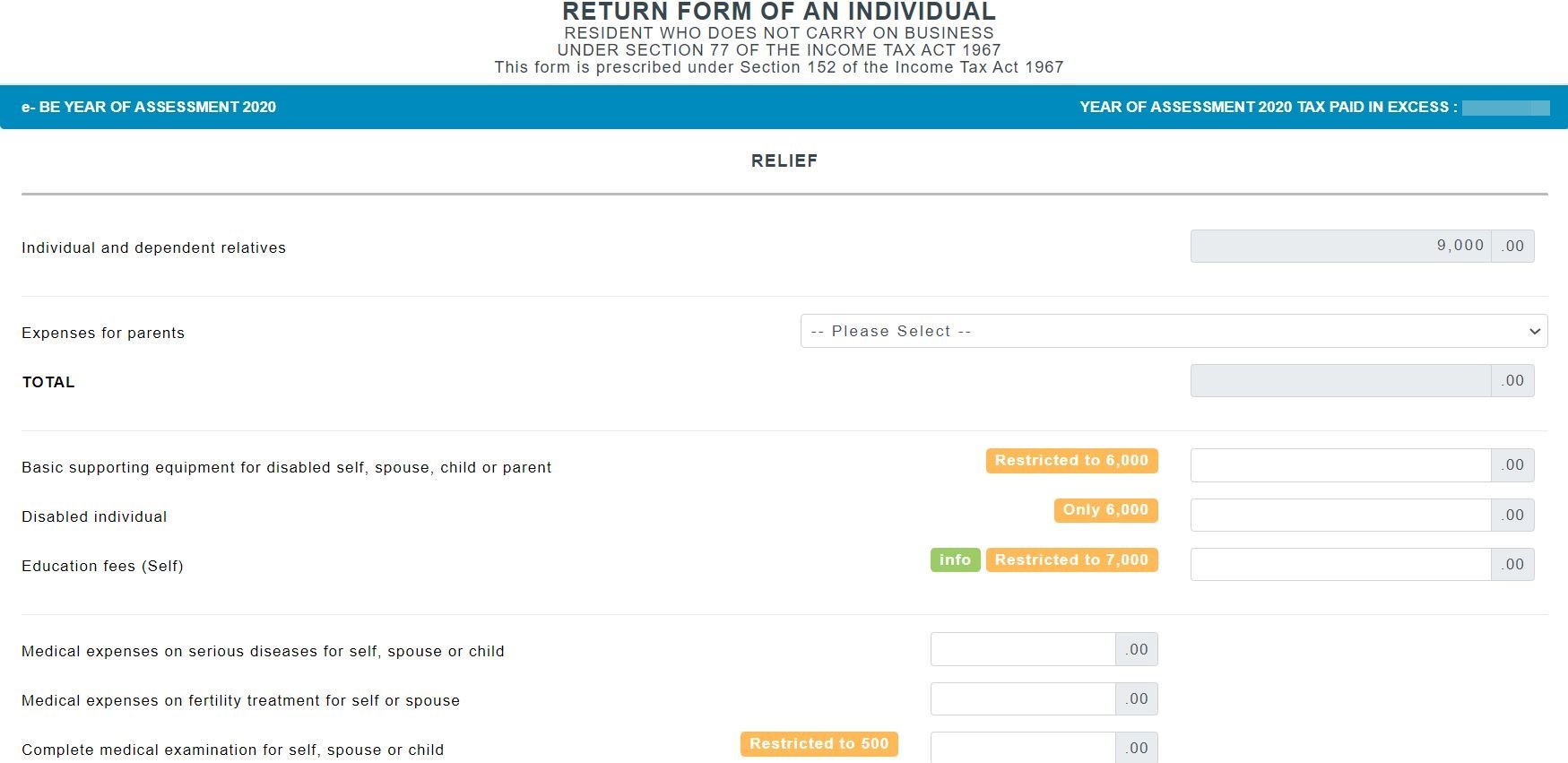

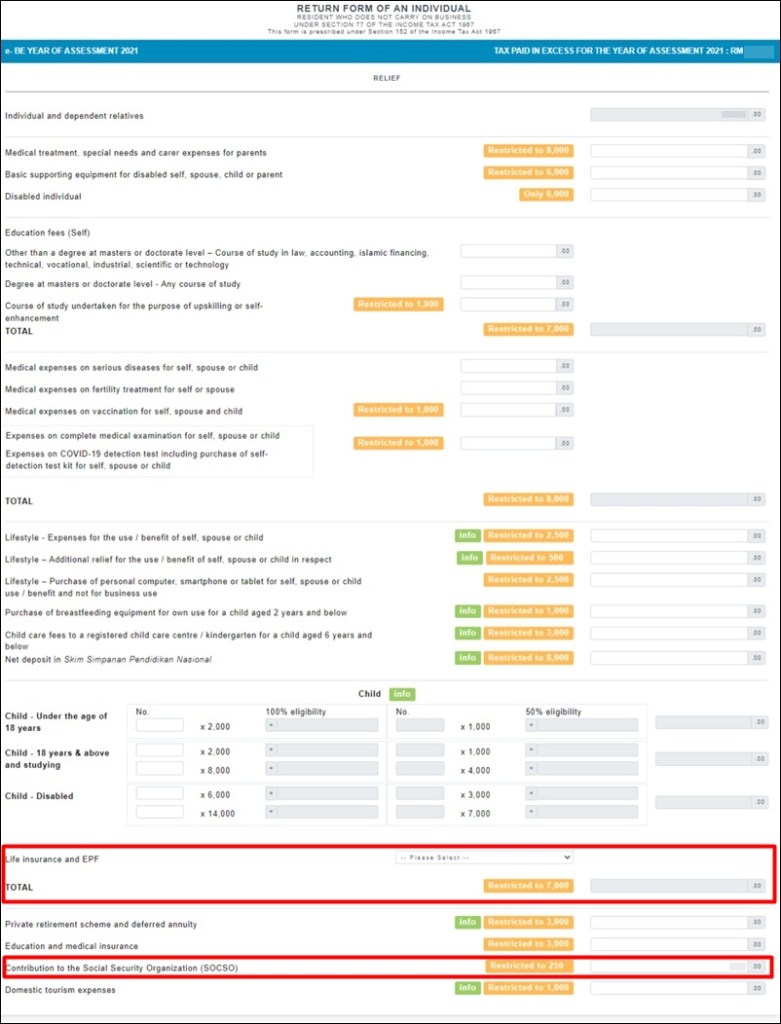

Usually employed individuals will fill up Borang e-BE.

. YEAR OF ASSESSMENTForm Amend. Simplified forms with explanations and guides on how to fill out those forms and compute the chargeable income and income tax have been prepared to assist taxpayers. 1 An individual who carries on a business is required to fill out the Form B.

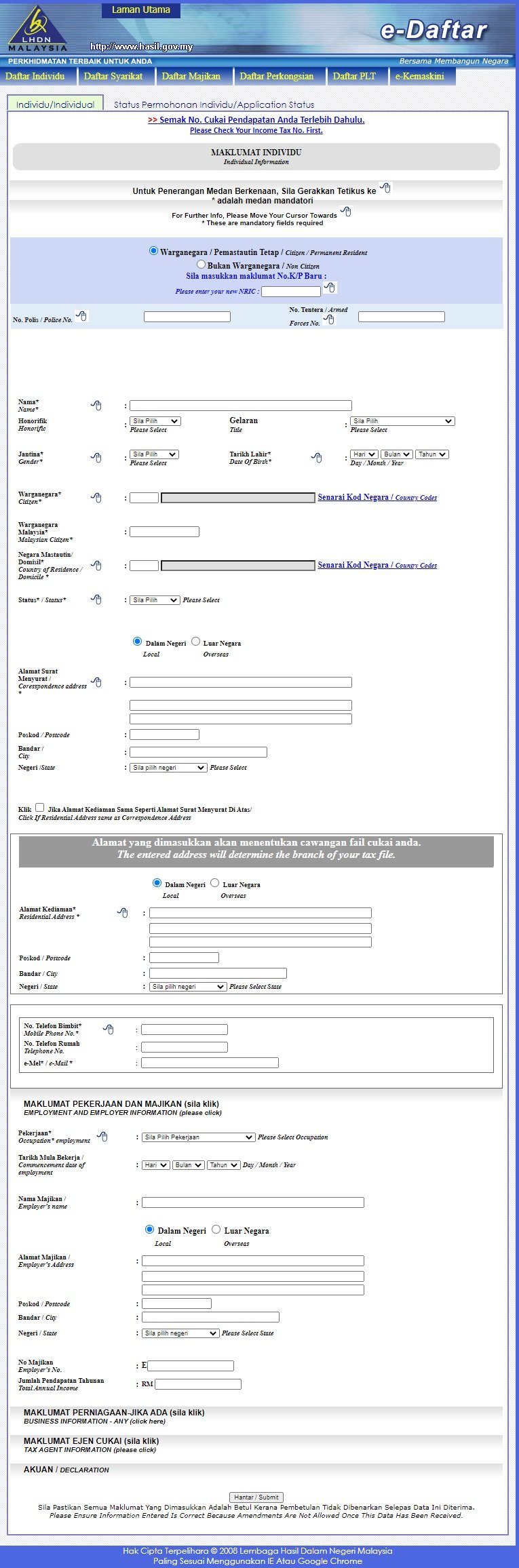

Tax File Registration. Income tax return for companies. Will penalty be imposed if I submit the Form B after 30th June.

After logging in youll find various tax forms for individuals from different sectors. Inland Revenue Board of Malaysia IRBM will issue a. 1 An individual who carries on a business is required to fill out the.

Business losses brought forward. In this form you will be able to declare your side income under Statutory income from interest discounts royalties pensions annuities other periodical payments and other. Form B Guidebook Self Assessment System 3 Reminder Before Filling Out The Form Please take note of the following.

2019 B LEMBAGA HASIL DALAM NEGERI MALAYSIA RETURN FORM OF AN INDIVIDUAL RESIDENT WHO CARRIES ON BUSINESS UNDER. WP0218 If Undelivered Return To. The deadline for filing income tax in Malaysia also varies according to what type of form you are filing.

What is Form B. 2 Married individuals who elect for separate assessment are required to fill out separate tax forms BBE ie. Change In Accounting Period.

What is Form B. B 2021 RESIDENT INDIVIDUAL WHO CARRIES ON BUSINESS 2021 YEAR OF ASSESSMENTForm BRETURN FORM OF LEMBAGA HASIL DALAM NEGERI MALAYSIA AN INDIVIDUAL RESIDENT. Amending the Income Tax Return Form.

Basis Period for Company. Amending the Income Tax Return Form. Form C refers to income tax return for companies.

Simplified forms with explanations and guides on how to fill out those forms and compute the chargeable income and income tax have been prepared to assist taxpayers. This form is prescribed under. PUSAT PEMPROSESAN MAKLUMAT LEMBAGA HASIL DALAM NEGERI MALAYSIA MENARA HASIL.

For the BE form resident individuals who do not carry on business the. One for the husband and one for the wife. Change In Accounting Period.

Extended from 15 July 2021 to 31 Aug 2021 according to LHDN. Calculations RM Rate TaxRM A. In the process of filing Form B a sole proprietor needs to prepare various information to determine the chargeable income and tax payable ie.

Statutory income from rents. Income Tax Act 1967 International Affairs. Form B Guidebook Self Assessment System 3 Reminder Before Filling Out The Form Please take note of the following.

Statutory income from employment. You will be charged a penalty under subsection 1123 of the ITA 1967. Self-employed individuals or employers.

Statutory income from all businesses and partnerships.

Business Income Tax Malaysia Deadlines For 2021

Business Income Tax Malaysia Deadlines For 2021

Sample Letter Of Intent Letter Of Intent Letter Sample Letter Example

How To File Your Taxes For The First Time

Malaysia Personal Income Tax Guide 2021 Ya 2020

2022 年大马报税需知 纳税人税率 Kadar Cukai 及如何计算税金 Map Screenshot Map Periodic Table

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Download Teacher Salary Slip Excel Format Exceltemple Teacher Salary Teacher Help Free Resume Template Word

How To File Your Taxes If You Changed Or Lost Your Job Last Year

3月1日起可开始报税 附上自行上网报税指南和截止日期 Leesharing Apply Job Word Template Ways To Save

Business Income Tax Malaysia Deadlines For 2021

Is Aadhaar Card Mandatory For Nri Cards Finance City Office

How To File Your Taxes If You Changed Or Lost Your Job Last Year

Hr Guide Tax Clearance Letter Form Cp22 And Form Cp22a

Malaysia Personal Income Tax Guide 2021 Ya 2020

Here S A How To Guide File Your Income Tax Online Lhdn In Malaysia